The idea of a future where advanced technologies have solved the economic problems of human want has been around for more than 100 years. It was John Maynard Keynes who prophesized nearly a century ago that we would suffer technological unemployment as he termed it – a period of economic abundance brought on by new technologies that would satisfy all of our economic needs and allow us to “devote our further energies to non-economic purposes.”.

While it is true that we are still waiting for this moment to arrive, the ever increasing momentum of the Industrial Revolution 4.0 as it has become known, is already giving us a glimpse of such a future.

Industrial Revolution 4.0 will be characterised by a fresh wave of innovation in areas such as driver-less cars, smart robotics, materials that are lighter and tougher, and a manufacturing process built around 3D printing. The automation of wage labour will lead to vast efficiency increases in the economy and ultimately release humanity from economic tasks for the first time. As these technologies continue their exponential rate of growth, an increasing number of products and services will be produced and exchanged across an unrestricted market at almost zero marginal cost.

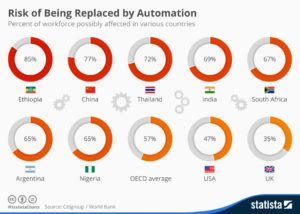

The huge structural changes that these ‘disruptive’ technologies will have on the economy are already becoming apparent. On one estimate, 47% of US jobs are at risk from automation. Worse still is the fact that the jobs that are at most risk are the jobs usually undertaken by low wage low skilled labour. Morgan Stanley recently forecasted that in the next 5 years’ driverless trucks will save the US freight industry more than $168 billion annually but at the cost of more than 5 million jobs.

It would have been inconceivable even ten years ago to imagine a scenario where the world’s largest taxi company (Uber) didn’t own any vehicles, where the world’s largest accommodation provider (AirBnB) didn’t own any buildings or where the world’s largest retailer (Alibaba) didn’t have any inventory.

The Fourth Industrial Revolution

Klaus Schwab whose recent book ‘the Fourth Industrial Revolution’ set the agenda for this year’s World Economic Forum in Davos compares Detroit in 1990 with Silicon Valley in 2014 to highlight the strain new technologies are already putting on the labour market. In 1990 the three biggest companies in Detroit had a market capitalisation of US$36bn, revenues of US$250bn and 1.2 million employees. In 2014, the three biggest companies in Silicon Valley had a considerably higher market capitalisation (US$1.09tn) generated roughly the same revenues (US$247bn) but with about 10 times fewer employees (137,000).

Renowned Futurist Paul Saffo, inspired by the now famous paper ‘Platform Competition in Two-Sided Markets’ by Jean-Charles Rochet and Jean Tirole, labels this new industrial revolution as the Creator Economy, whereby developed nations have shifted from a consumer economy where ‘making stuff’ is at the core, to a Creator Economy whereby consumers are now generating content and data, either knowingly or unknowingly. He points out that the largest tech companies such as Google and Facebook do not charge a fee but make their money off the data that we create just by living our lives through their platforms.

But much like globalisation, the aggregate benefits of the Creator Economy are not spread equally – just ask burgeoning musicians who, in an era where creating and disseminating creative content has become all but free, there are no longer the golden record deal handshakes that there once had been. Fans are more likely to “subscribe” now than they are to “buy”. Compare that to the professional video game players who are now making fortunes playing in competitions around the world or the travel bloggers making their own fortunes by documenting their journey’s to worldwide online audiences.

There are greater structural issues than poor musicians however; if the economy is shifting to new mega companies that make money by collecting our data in order to improve how they sell products and services to us, where will we get the money to buy these products and services? This questing becomes especially important when we observe that the economic benefits of this nascent shift in our economic architecture is already concentrated among a relatively small elite, exacerbating the trend towards greater levels of inequality.

Why inequality breeds instability: Distributive Fairness.

There have been numerous academic studies linking inequality with political instability. Many of the concepts however are lost in esoteric academic jargon as they try to prove some fundamental truths about human nature, key among them is the innate concept of distributive fairness. A body of experiments conducted by Herbert Gintis and other behavioural psychologists in fifteen diverse societies used an ‘ultimatum game’ experiment to demonstrate this concept. In the game, one person, Person A, is given $100; they are then told that they must offer some part of that $100 to another person, person B, the catch being that if Person B rejects Person A’s offer, neither of them get any money. Traditionally economists believed that we all made rational decisions and with that and the Nash equilibrium in mind, any offer of $1 or more should be accepted. It turns out that wasn’t the case; in actual fact, even in blind tests, the majority of offers below $20 were rejected, leaving neither party with any money. This experiment has been repeated with children of various ages and even with chimpanzees, all with similar results. The main divergence with children was that their ingrained sense of fairness was even stronger and the average amount that was rejected was even higher than among adults.

Numerous other studies have concluded similarly that humans have both an innate sense of distributive fairness but also of altruistic punishment, that people reject unfair offers to teach the first player a lesson and thereby reduce the likelihood that the player will make an unfair offer in the future. This concept feeds strongly into the problem with inequality. Humans have an in-built sense of fairness and an expectation of distributive fairness while also being willing to give up a certain amount in order to punish those who break the rules of distributive justice. This is the foundation that civil and social unrest is built upon.

The People Revolt

The effects of an Industrial Revolution 4.0. paradigm shift in our financial and labour market dynamics will not be limited to economics but will also mark a profound generational shift in the social contract in many developed countries – something for which most policy makers are unprepared for.

In 2016 alone we already started to see the cracks in the system; the rise of popularist candidates across Europe and the United States, the Brexit vote, the failed Colombian peace deal, a general hostility to globalisation and free trade, stubbornly low growth rates, negative bond yields and an aggregate rise in political instability in developed markets; these are all indicators of a growing sense of disenfranchisement by the general populace and a growing hostility towards political elites.

If we look at the United States and the growing support for candidates such as Trump and Sanders, we can see that there is a perception among the working and middle class that upward mobility and ultimately the American dream are goals that are no longer attainable. The American social contract relies heavily on the aspirational, public policy has tact towards creating the conditions for social upward mobility rather than the conditions that guarantee a core minimum; in other words, unlike in Europe, American’s have been willing to accept a lower base standard of living in exchange for the conditions that could potentially allow them to rise well beyond their present condition: equality of opportunity over equality of outcome.

But as the jobs that would secure this upward mobility start to disappear, American voters have begun to realise that aggregate growth in the US economy does not mean aggregate benefits for all. The growing inequality in the United States is leading many to believe that the American Social Contract is becoming broken promise, that the American Dream is becoming an illusion.

For Political Scientists, many of whom have been caught out by the speed of this disenchantment, we need to look at how the social contract may change under these tectonic shifts and what potential public policy responses may arise.

We discussed distributive fairness previously but in a country like the United States where the idea of ‘re-distribution’ is usually met with hostility, how will policy makers respond to the demands for greater economic equality in an environment where the jobs may not actually exist anymore?

That last part may seem controversial, the jobs won’t exist? Sure they will, new technology will bring new types of jobs. This argument sits within the historical context of the fact that at the turn of last century, 97% of jobs existed in the agricultural sector whereas today it makes up less than 3% of the labour market. The third wave of technological advancements that liberated us from working in the field also created a huge array of new jobs for us to fill. This will be true of the Industrial Revolution 4.0. The difference however will be two fold; the first is that these jobs will be far fewer than those that will become automated and second, the lighting speed of this rate of change will leave most low skilled workers without the requisite skills to undertake these new jobs. This is already beginning to happen.

Twentieth century welfare debates have centred around how we support people back into employment, the assumption being that either the jobs will exist or that they be created under the right circumstances. Those underlying assumptions will be soon be obsolete.

So, if we take the United States for example, what options do policy makers have to avoid moral hazard, a people’s revolt and extreme inequality while at the same time preserving the legitimacy of the system and the social contract? One option is a Universal Basic Income policy.

Universal Basic Income

The concept of a Universal Basic Income often strikes people as being counter-intuitive because most of our welfare programmes up until now have been encouraging people back into work, not paying them not to work. Unlike almost any other concept these days however, it does have stronger supporters on both sides of the political divide; in fact, in 1969 and on the advice of economists such as Milton Freidman, President Richard Nixon unveiled a basic income scheme for needy families with children called the ‘Family Assistance Plan’ (FAP). Under Nixon’s FAP, a family of four would receive $1,600 annually from the federal government, equivalent to about $10,500 today. Unfortunately, the plan also shared bi-partisan critics as well as supporters and failed to pass the Senate. The Democratic Senator George McGovern proposed a similar program in 1972 and was only narrowly defeated.

Similar programmes in countries like Canada, Denmark and India have proven exceptionally successful. Some of the traditional criticisms of UBI such as disincentivizing workers will be largely irrelevant in the context of the new economic realities. Some claim that the opposite may be true anyway, that if you look at the 18th and 19th century, some of the great scientific breakthroughs and some of the great cultural breakthroughs were made by people who did not have to work, from Galileo to Adam Smith to Charles Darwin. It has also been pointed out that some of the hardest working people, especially in Silicon Valley, are some of the world’s richest people like Bill Gates and Mark Zuckerberg. The assertion is that while some, potentially many, will stay home and play videogames, another proportion of people, free of their everyday obligations to paid work, will go off and finally start that company, write that program or paint that picture they had always wanted to.

Such a plan would however have huge implications for the social contract and for government policies designed to fund the programme. One of the key criticisms of the plan is the heavy tax burden it would put on wealthy individuals. While this is true, it should be noted that high taxes do not automatically contribute to economic downturns, in fact, for many of the most prosperous years for the US economy, corporate tax rates were in excess of 70% and throughout the 1950’s, the golden age of US manufacturing, the figure was as high as 91%. Today, corporate tax receipts make up only 9% of government revenue and less than 2% of annual GDP. In 2011 46% of households already paid no federal income tax.

Such high taxation may have some heavy consequences for the economy in the beginning, but high rates of unemployment in a system where consumers rather than capital drive the economy would have far worse consequences. In such a scenario businesses would struggle to make the taxable profits in the first place. The problem can be summed up in the famous exchange between Henry Ford and the leader of the automobile workers’ union, Walter Reuther at the unveiling of the newly built and highly-automated Ford factory when Ford quipped “Walter, how are you going to get those robots to pay your union dues?” to which Walter replied “Henry, how are you going to get them to buy your cars?”.

There are other challenges however. In Gulf States that have something like a Universal Basic Income, we can observe strong authoritarian mandates through ‘reciprocal obligations’ whereby the citizenry is expected to conform to a certain moral or social standard in exchange for their guaranteed income.

There is also the issue of ‘idle hands’, of boredom and a loss of dignity, something that has traditionally been defined by employment. The concept of human dignity is not abstract in political science; Francis Fukuyama aptly pointed this out by using the example of the incident that triggered the Arab Spring; Mohamed Bouazizi, who had his vegetable cart repeatedly confiscated by the authorities and who was slapped and insulted by the police when he went to complain decided to self-immolate himself in protest of the repeated denial of his basic dignity. Social and political unrest can occur under a number of pre-conditions. I remember being told by an ex-Kosovo Liberation Army soldier that he desperately missed the war there because during the war he had a purpose and people respected him. I also once heard a World War 2 vet say that the war was about the only time he ever felt like he knew what he was doing. The concept of the angry, bored and disenfranchised youth is something that policy makers would need to manage carefully under any form of Universal Basic Income.

The time is now.

Many of the disruptive forces that technology will unleash are already upon us; it is incumbent on business leaders and policy makers to start looking at solutions and opportunities in the face of these changes or risk being caught out by one of the greatest structural changes in history.