Trump is making yet more headlines today with a threat to impose $60 billion worth of trade tariffs on China. This has been the nightmare scenario of many market participants of late. History demonstrates that trade wars are hugely destructive and generally result in an aggregate loss for all parties. Paired with the tech stock slump yesterday which saw Facebook stock drop nearly 7%, we saw the VIX spike 16.33% to 18.38 and the SPX fall 1.4% by last night.

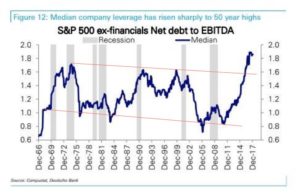

While we have made our views on the US market quite clear in previous client briefs, as well as our views on exogenous geo-political risks, the latest risk of a trade war is one of the first signs of a potential endogenous political risk in the US market since the issue of sequestration in 2017. Fundamental political and constitutional constraints as well as scandal after scandal have largely pacified Trump-related market risks but a trade war with China or the EU could have serious consequences for a US market deep into a credit driven 10-year bull market where both valuations and corporate Net Debt are at all-time highs, where the Fed is likely to raise rates and where inflation is starting to appear at street level.

Our broader concern is that negative correlations that underpin many clients’ portfolio allocations may start to break down. In previous briefs we have discussed the positive market conditions and valuations in EM’s which have all enjoyed a stellar two years of performance and have provided excellent diversification options. A trade war would however have implications across global markets reducing the effect emerging markets as an uncorrelated trade to US markets. This should be of concern to those who have used EM as a diversification or risk management tool in relation to US equity markets especially.

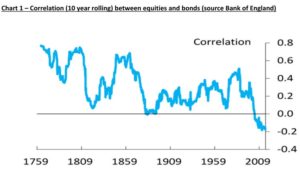

Equally, a trade war could create the narrow conditions required to cause stocks and bonds to break their negative correlation and move lower in tandem. This is not unprecedented and recently we have seen this negative correlation break down for short periods. Given that Risk Parity strategies and Modern Portfolio Theory has underpinned the portfolio decisions of many investors and clients, we consider this to be a risk worth paying attention to, especially in light of what we consider to be a number of mis-priced corporate and sovereign bonds. My personal favourite example of this is Lebanese Government Bonds, a country with the third highest debt to GDP in the world and in perpetual political turmoil, and yet these bonds are yielding just 7.2%. In the current interest rate environment it may be difficult to accurately calculate the risk free rate, but market risk doesn’t just disappear because liquidity is high.

The last throws of a bull market can often be where the largest gains come but 200 years of market data also demonstrates that Volatility cannot stay at the low levels it has for very long. With mounting Geo-Political risks and now with domestic political risks on the rise, we see the probability of a spike in market volatility in the next six months as being exceptionally high.

If we see volatility drop back down in the coming days, this may be the time to start expressing trade ideas or hedging some market risk using Options rather than outright market exposure. If volatility does move back into the market in the coming months as interest rates rise, this could be a positive environment for Options, both long and short. Buying Options at such low Implied Volatility can provide an excellent hedge against sudden downturns, and provide low risk opportunities for participating in the ‘melt up’, not simply because risk is limited to the premium paid but because extreme market conditions can even, at times, push the prices of all Options upward. In the 1987 crash even Call Options spiked in value despite their underlying stocks crashing because of the extreme spike in Volatility.

Without being alarmist and recognizing that our role at Pozières Consulting is to concentrate on risk, the reference to 1987 is not for nothing! The recent low levels of volatility and general complacency in the market betrays the significant number of potential fat tail risk events that lay in wait. We believe now is the time to concentrate on risk management.

No Solicitation or Investment Advice

The material contained in this brief, including the ‘Clients Only’ portion is for informational purposes only. Nothing in this brief constitutes or forms a part of any offer for sale or subscription of, or any invitation to offer to buy or subscribe for, any securities, nor should it or any part of it form the basis of, or be relied upon in any connection with any contract or commitment whatsoever. The material is not to be construed as an offer or a recommendation to buy or sell a security. The material is not to be construed as investment, accounting, taxation or legal advice. Please contact Pozières Consulting directly for personalized professional advice.